How Well Is Your Investment Serving You?

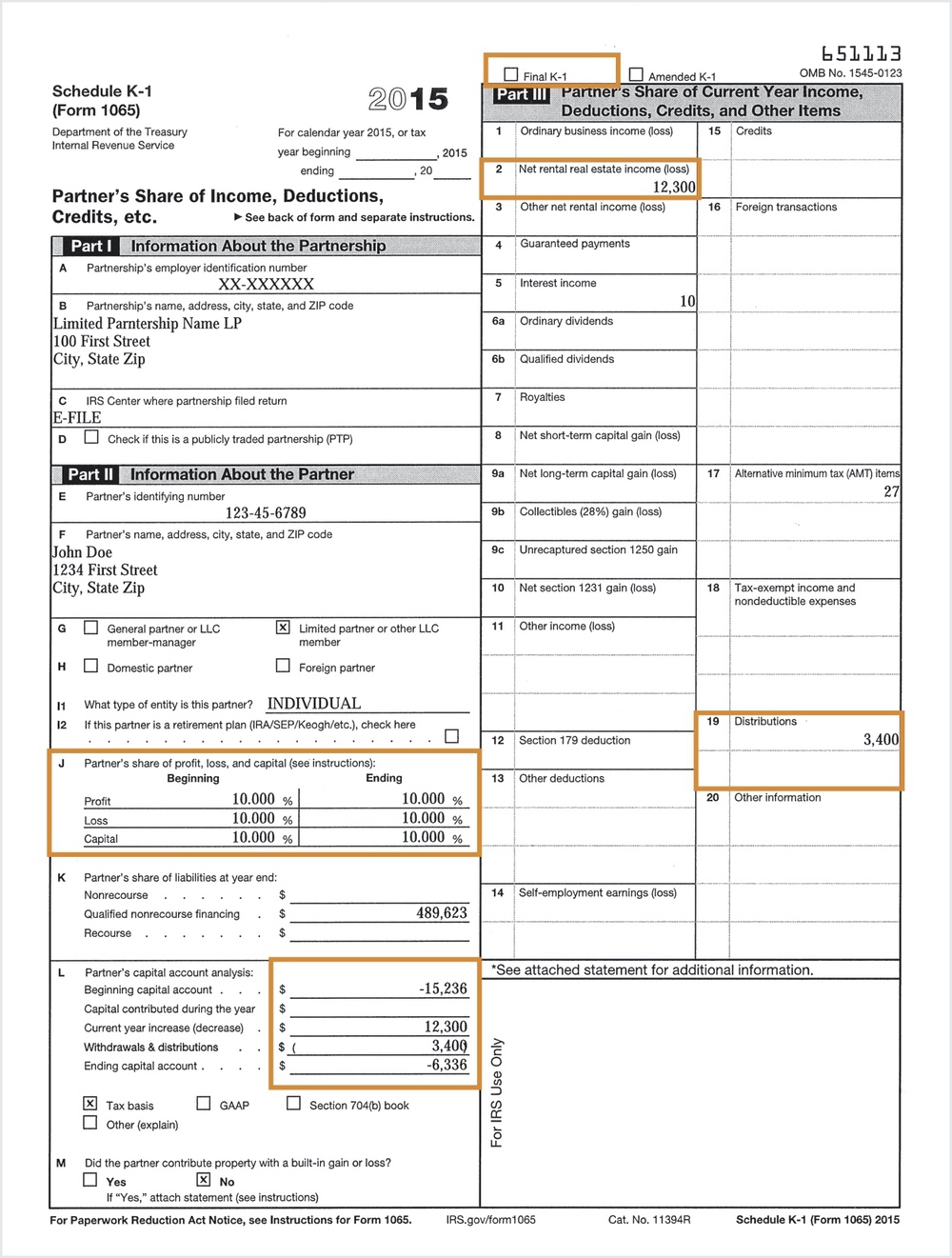

A Schedule K-1 form can be difficult to decode, but it holds valuable data relating to the health of your interest. Find out if your limited partnership interest is working for you with the help of our step-by-step K-1 breakdown. We have a great deal of experience in these matters and can provide an opinion on the taxes associated with the potential selling of an interest, however we do encourage all clients to consult with their personal tax advisors before finalizing any sale.

Frequently Asked Questions

The founders of LPE have a long-term investment objective and the ability to absorb phantom income is built into the structuring of the portfolio. We employ a strategy of diversification by investing into hundreds of limited partnership throughout the United States, and it is through this diversification that we are able to lessen the risk associated with owning these interests.

LP Equity, LLC (“LPE”) is a company based in Wilmington, North Carolina whose founders have over 25 years of experience in the industry. We are well aware of the difficulty that limited partners have in finding a buyer for their partnership interests. Our business strategy is to provide a market for limited partners and thereby enhance the value of the partnership interests.

Payment for your interest will be made in full by certified check or wire transfer no later than 30 days after the signed agreements have been returned. Most transactions are closed within 3 days of receiving the signed agreements.

The tax implications depend a great deal on the ending capital account that is reflected on the K-1. If the capital account is negative, then there is recapture tax associated with a sale. In most circumstances, we can provide an amount in terms of an offering price that will more than cover these associated taxes. If the capital account is positive, it is possible that the transaction could be tax free. We have a great deal of experience in these types of transactions and can provide an opinion on the taxes associated with the potential selling of an interest. We do, however, encourage all potential sellers to consult with their personal tax advisors. Likewise, we are always happy to discuss any potential offers with tax advisors directly.

By allowing us to make an offer proposal you will gain insight into the potential value of your interest. Even if you decide not to sell your interest at the time the offer is made, you will have a better understanding of what you own and what the future might hold for the partnership you are a part of.

We currently have access to databases and information sources that allow us to evaluate interests and make formal offer proposals quite quickly. In most circumstances all that is needed to make an offer are the K-1s issued by the partnership over the past two years. The K-1s will allow us to confirm your current ownership percentage and verify any annual distributions the partnership is making so that we can accurately account for them in our offer.

By selling your interest, you will first and foremost liquidate your investment, realizing its value immediately. Additionally, you will eliminate future K-1 reporting, avoid the unending annual payment of income tax on the investment, and simplify your estate planning.

Interested In Learning More?

We ask that you contact Jay Landen or Adam McNutt (910-509-7202 direct) to discuss how our acquisition program could benefit you and your clients.